17.04.2025 11:02 AM

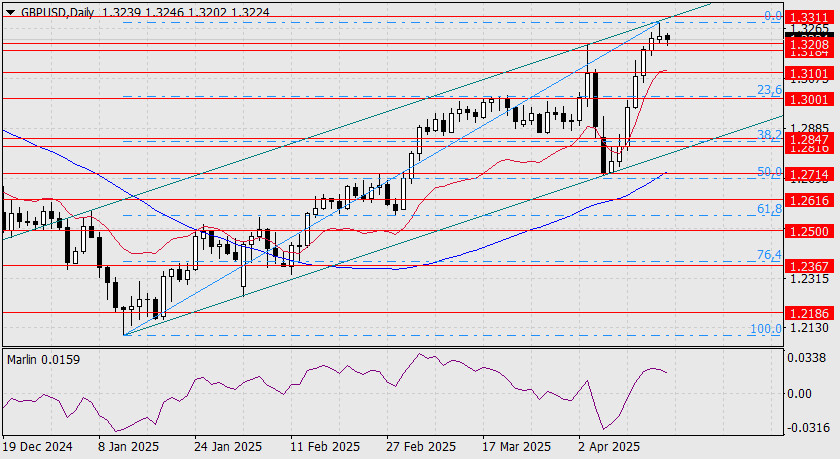

17.04.2025 11:02 AM昨日,英國公布了三月份的通脹數據。核心消費者物價指數(CPI)從年增率3.0%下降至2.8%,而總體CPI從年增率2.8%下降至2.6%,低於2.7%的預測值。英鎊試圖朝1.3311的目標水平上漲,但未能如願,當天僅上漲了11點。今晨,價格已移動至1.3184–1.3208的區間。

然而,日線圖顯示價格精確測試了上升價格通道的上邊界。這個測試比我們預計提前了一天進行,但多頭已經完成其任務,一切都準備好迎接反轉。

從1月13日至4月16日的增長情況可以用費波那契網格完美描述。23.6%的回撤水平與我們在1.3101的支撐相吻合,而38.2%的水平與1.2816/47的目標範圍一致。Kruzenshtern線也正向該區域移動。若跌破此支撐,可能會為英鎊長期下跌鋪路。

在四小時圖上,價格正在嘗試進入1.3184–1.3208的支撐區域,同時Marlin振盪器達到下行趨勢區域的邊界。價格和振盪器同時突破支撐位將加強看跌動能。第一個目標是1.3101。

週三,EUR/USD貨幣對繼續下跌,並穩定在1.1260–1.1282支撐區以下。因此,今日的價格下跌可能會向下一個斐波那契回撤位23.6%即1.1186推進。

在小時圖上,週三英鎊/美元對跌至1.3425水平。若從該水平反彈,將對英鎊有利,並可能帶動其上升至1.3520的161.8%斐波那契回撤位。

由於美國法律訴訟的啟動以及美元在外匯市場的走強,黃金價格持續承壓。許多市場參與者似乎押注特朗普對「深層政府」的戰鬥最終可能失敗,這將顯著緩解全球緊張局勢並推動風險資產需求。

在部分连续三日下跌后,英鎊已達到1.3433的目標支撐位。在日線圖上,Marlin振盪器尚未觸及其上升通道的下邊界,並繼續拉低價格。

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.