15.12.2023 01:35 PM

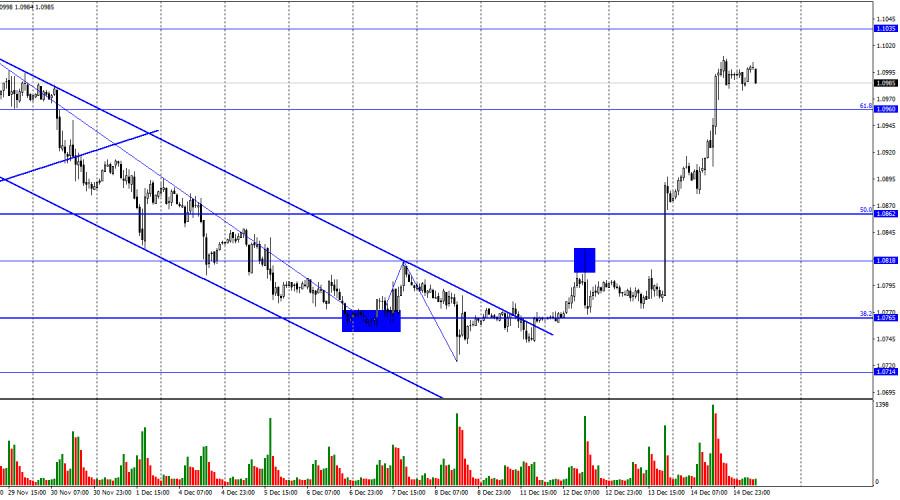

15.12.2023 01:35 PMThe EUR/USD pair on Thursday experienced growth to the corrective level of 61.8% (1.0960) and solidified above it. Such a strong rise in the European currency was caused by the information background on Wednesday and Thursday. It turned out that traders were not prepared for Jerome Powell's comments and new stance. Christine Lagarde's speech only added fuel to the fire. Thus, the process of the euro's rise may continue towards the next level at 1.1035. The consolidation of the pair's exchange rate below the level of 1.0960 will work in favor of the American currency, with some decline toward the Fibonacci level of 50.0% (1.0862).

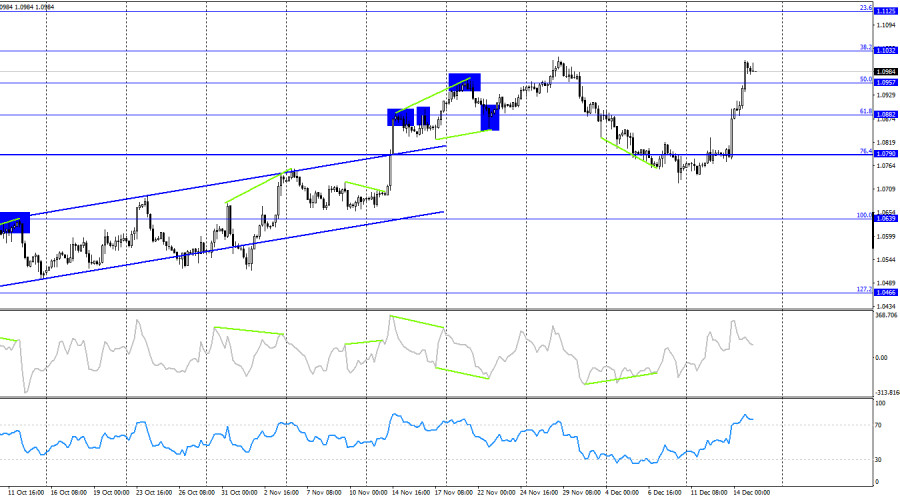

The wave situation has become not more complex but less appealing. We are accustomed to market movements proceeding fairly smoothly, so any sharp rise or fall causes panic among all traders and analysts. The last upward wave has overlaid all previous waves. The trend has changed to "bullish" at the moment, but now practically any downward wave will not be able to change it back to "bearish." For the resumption of the "bearish" trend, the euro needs to fall by 250–300 points. The euro has soared, and now what will its landing be like?

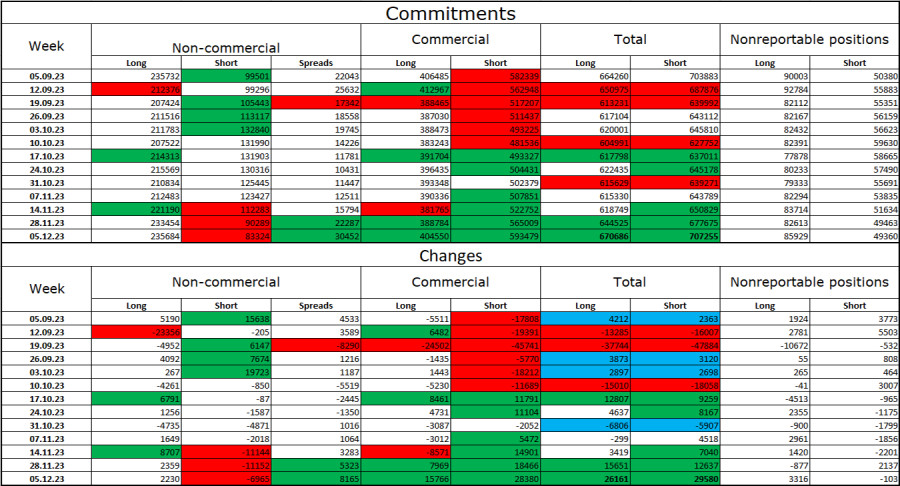

Jerome Powell has been regularly stating for a long time (all the last months) that the process of tightening monetary policy is not complete. He repeatedly drew the market's attention to the fact that inflation remains very high, speaking about rate cuts prematurely, and the Federal Reserve could raise the rate at any moment by one or even two more times. However, on Wednesday evening, he unexpectedly stated that rates would be lowered next year, and this statement alone could cause a total collapse of the US dollar. If the talk is now about rate cuts, decisions on hikes will not be made. Powell said, "Rate hikes are unlikely."

Yesterday, Christine Lagarde "added fuel to the fire," unlike Powell, who did not talk about easing monetary policy next year. The situation now is as follows: is the Federal Reserve ready to start lowering rates, and is the ECB not? Powell's abrupt change in rhetoric is a reason to get rid of the dollar. Maintaining Lagarde's hawkish position is also a reason to get rid of the dollar.

Is there hope for the dollar to rise now? In my view, expecting a strong rise in the US currency in the near future is not advisable. If the ECB signals its readiness to start easing early next year, then the dollar will start having a trump card in hand. Right now, it can only count on a corrective rise.

On the 4-hour chart, the pair has made a reversal in favor of the European currency and consolidated above the 50.0% Fibonacci level at 1.0957. This consolidation allows counting on the continuation of growth towards the next corrective level at 38.2% (1.1032). No imminent divergences are observed in any of the indicators today. The "bullish" trend continues, but a bounce off 1.1032 or a close below 1.0957 will allow bears to regain some of the lost positions over the past two days.

Forecast for EUR/USD and trader recommendations:

What can be advised to traders in the current situation? Further growth of the euro today is unlikely. The euro will find it extremely difficult to find support in business activity reports due today in the EU and Germany. I believe that the pair may rise to the level of 1.1035 on the hourly chart, but it will be very difficult for it to climb higher. Upon consolidation below the level of 1.0960, I advise opening sales with a target of 1.0862 on the hourly chart. On a rebound from the level of 1.1035, I also advise selling the pair.

美元/日元貨幣對已連續上漲四天,但需要注意的是,日線相對強弱指數(RSI)顯示超買狀況,這使得交易者不敢新增多頭倉位。因此,在計劃進一步上漲之前,保持短期盤整或小幅回調會更為謹慎。

週三,歐元/美元兌換組合在從1.1594的61.8%回調水平反彈後,對美元轉為有利。隨後,該組合下跌至1.1517的76.4%回調水平。

在小時圖上,週三英鎊/美元匯率在1.3110的161.8%回調水平下方盤整,從而退出了橫盤區間。匯率下降幾乎達到200.0%的水平,即1.3024。

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.