28.03.2022 11:22 AM

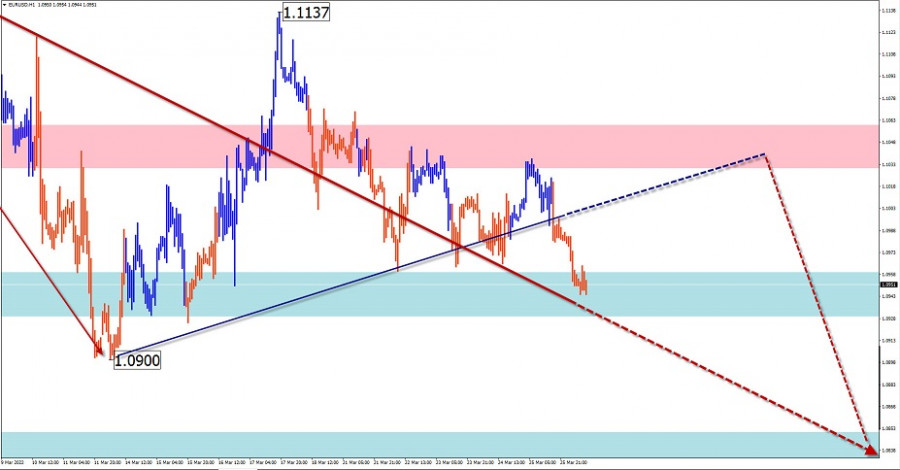

28.03.2022 11:22 AMEUR/USD

Analysis:

The daily chart shows the downtrend of the European currency major over the last year and a half. The incomplete section started on March 9 this year. Analysis of the structure of this wave shows the absence of the final part (C).

Forecast:

In the nearest trading sessions, we can expect a flat movement, mainly sideways. Short-term price growth is possible, not higher than the estimated resistance. At the end of the day, trading activity is likely to increase, with the resumption of the downward movement. In case the lower border of the nearest support is breached, the decline will continue to the next zone.

Potential reversal zones

Resistance:

- 1.1030/1.1060

Support:

- 1.0960/1.0930

- 1.0850/1.0820

Recommendations:

There are no buying conditions in the euro market today. It is recommended to refrain from trading the pair until there are confirmed sell signals.

USD/JPY

Analysis:

The Japanese yen has been weakening rapidly against the US dollar since the beginning of this year. The ascending impulse wave brings the price closer to the lower border of the preliminary target zone. The structure of the wave looks complete, but there are no signals of an imminent reversal.

Outlook:

A continuation of the general upward movement of the pair's exchange rate is expected today. Short-term stops in the form of sideways sections are possible during the day.

Potential reversal zones

Resistance:

- 125.00/125.30

Support:

- 123.40/123.10

Recommendations:

There are no conditions to open short positions in the yen today. It is recommended to watch for buying signals at the end of all counter-movements.

GBP/JPY

Analysis:

The trend direction of the English Pound/Japanese Yen cross over the last two years is set by an ascending wave algorithm. The incomplete section traces back to March 8. The price movement has a clear impulsive nature. By now the price has sold the level of the intermediate resistance zone.

Outlook:

In the near future, the general upward movement vector is expected to continue. On the forthcoming session short-term flat is possible along the support zone. The highest activity is likely at the end of the day, or tomorrow.

Potential reversal zones

Resistance:

- 163.80/164.10

Support:

- 162.50/162.20

Recommendations:

In the cross market today, we recommend to look for signals at the end of all counter-movements to buy the instrument.

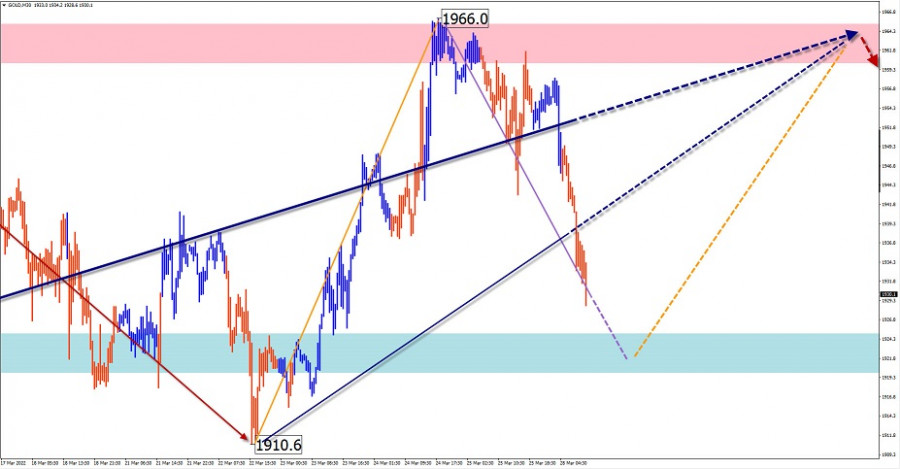

GOLD

Analysis:

The downward wave from March 8 is setting the main direction for gold's price swings. An intermediate correction has been forming in the last 2 weeks. The structure of this move is not complete.

Outlook:

In the current day, the end of the downward movement, the formation near the support zone of the reversal and the resumption of price growth can be expected. A breakout beyond the boundaries of estimated resistance is unlikely.

Potential reversal zones

Resistance:

- 1960.0/1965.0

Support:

- 1925.0/1920.0

Recommendations:

Trading in the gold market today is risky and could lead to losses. Short-term buying with fractional lots will be possible after reversal signals appear in the support area.

Explanation: In simplified wave analysis (SVA), waves consist of 3 parts (A-B-C). The last unfinished wave is analysed. The solid arrow background shows the structure formed. The dotted arrow shows the expected movements.

Attention: The wave algorithm does not take into account the duration of the instrument movements over time!

在四小時圖的歐元/美元走勢中,波浪型態已轉變為看漲形態。可以肯定地說,這一變化完全是由於美國的新貿易政策引起的。

在GBP/USD的圖表上,波浪型態也轉變成了一個看漲的衝動結構——這要「歸功」於Donald Trump。波浪圖形與EUR/USD的情況非常相似。

因「謝謝」Donald Trump的緣故,GBP/USD 的波浪形態也轉變為看漲的衝動結構。其波浪結構幾乎與EUR/USD相同。

在歐元/美元的4小時圖中,波浪形態已轉變為一個向上、衝擊性的結構。我相信幾乎沒有懷疑這次轉變完全是由於美國新貿易政策造成的。

在 4 小時圖上,EUR/USD 的波浪結構已轉變為看漲的衝動形態。我相信沒有人會懷疑這一轉變純粹是由於美國新的貿易政策的影響。

由於唐納德·特朗普的影響,英鎊/美元(GBP/USD)的波浪結構也轉變為看漲的衝動形式。其波浪模式與歐元/美元(EUR/USD)的幾乎相同。

在GBP/USD的圖表上,波浪模式也因為唐納德·特朗普而轉變為看漲的推動結構。這個波浪模式幾乎與EUR/USD的相同。

在EUR/USD四小時圖上的波浪結構已轉變為看漲形態。我認為,這一轉變完全是由於新的美國貿易政策所造成的。

英鎊/美元的波浪結構也轉變為看漲的衝擊型態——這要"歸功於"Donald Trump。波浪圖與歐元/美元的情況幾乎完全相同。

InstaForex俱乐部

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.