06.01.2022 10:30 AM

06.01.2022 10:30 AMIt will be known at 13:30 Universal time today if the number of initial claims for unemployment benefits in the US has increased. At 15:00 Universal time, the index of business activity in the service sector of the Institute of Supply Management (ISM), which reflects the activity in the service sector for the previous month will be released. It is very likely that these indicators will be lower than expected, which will serve to continue the development of the bearish trend.

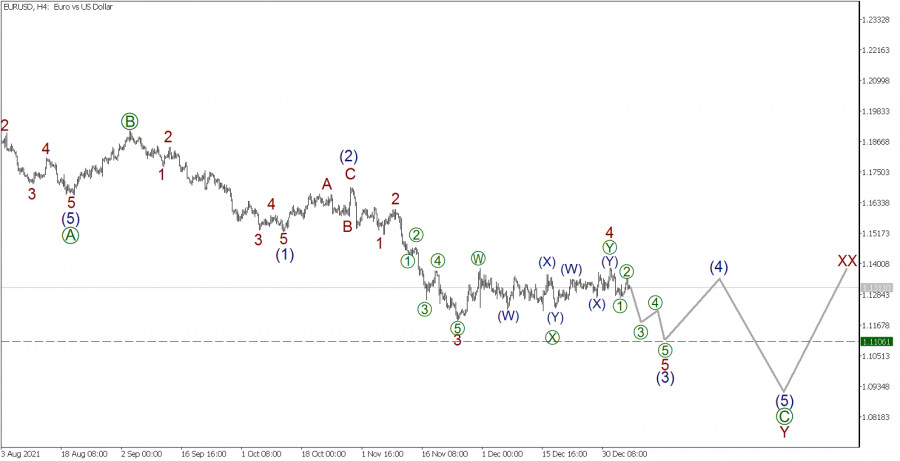

EUR/USD, H4 timeframe:

The formation of a descending wave Y, which is part of the large triple zigzag [A]-[B]-[C, can be observed]. Sub-waves [A]-B] – impulse and correction were fully done.

At the moment, there is a decline in the market within the bearish wave [C], the structure of which hints at momentum. As part of wave [C], only the first two sub-waves (1)-(2), as well as the first four parts of the sub-wave (3), are fully completed, that is, they speak of waves of a smaller wave level 1-2-3-4.

It is assumed that the correctional sub-wave 4 is already completed, which is a double three [W]-[X]-[Y]. Now, the initial part of the last sub-wave 5 can be seen, which can take the form of a simple impulse [1]-[2]-[3]-[4]-[5]. Its approximate internal structure is shown in the graph.

There is a possibility that the upcoming news release, which is mentioned above, will help the bears to accelerate and take the price to the level of 1.1106. After reaching this level, the price may start correcting in wave (4).