07.12.2021 11:30 AM

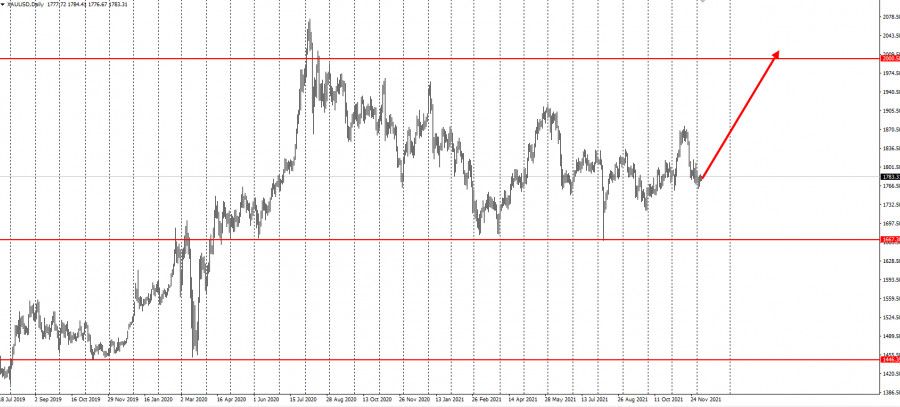

07.12.2021 11:30 AMThe gold market continues to struggle because investors are reacting to the hawkish rhetoric of Fed Chairman Jerome Powell.

Until three weeks ago, investors were all about keeping gold in their portfolio, trying to protect themselves from rising inflationary pressures. But now the Fed appears to be taking the threat more seriously, which, in turn, raises expectations for tighter monetary policy in the near future. Many anticipate an announcement of a much faster reduction of bond purchases in December.

But even if expectations begin to change, the broader investment landscape remains the same. Despite Powell's new aggressive stance, most economists and market analysts believe the Fed will lag behind the inflation curve. This means that real interest rates will remain negative, which will be good for gold.

Leigh Goehring, managing partner of Goehring & Rozencwajg Associates, said the long-term target for gold is $ 20,000 per ounce.

"We're getting closer to the explosion of gold prices to the upside. I'm a big believer that inflation is not going away. It's going to continue to be a problem," he said.

Meanwhile, Gerald Moser, chief market strategist at Barclays Bank, said gold prices will rise 20% over the next 12 months.

Although investors are ignoring gold as a hedge against inflation, other central banks are paying much more attention to it. The central bank of Singapore and the central bank of Ireland bought gold for the first time in decades.

Singapore reportedly bought 26.35 metric tons of gold between May and June, which was the first gold purchase by an Asian central bank since 2000. Ireland, on the other hand, bought two tons of gold, its first purchase since 2009.

Ireland's central bank governor, Gabriel Makhlouf, also said inflation was a growing concern for him.

國際貨幣市場一片混亂。那些認為美國政府關門結束會為聯邦儲備系統和投資者帶來明晰的人錯了。

名聲不會永久不變。今天看似完美的事物,明天可能變得平凡。

週四將發布多項宏觀經濟報告。首先是英國的數據。

歐元對美元貨幣對在週三交易平靜。全天交易者都缺乏顯著的消息,因此並無什麼值得反應。

美國對來自印度的所有進口商品仍維持50%的關稅。最近,唐納德·特朗普宣布與新德里的談判取得突破,並宣告達成一項「誠實和公平的貿易協定」。

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.