CHFSEK (Swiss Franc vs Swedish Krona). Exchange rate and online charts.

Currency converter

16 Apr 2025 05:48

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

CHF/SEK, a cross rate against the U.S. dollar, is not so popular with Forex market participants. Although the U.S. dollar is not present in this currency pair, it still has a great impact on it, which is easy to see if you combine the USD/CHF and USD/SEK charts. By combining these two charts, we get an approximate CHF/SEK chart.

The U.S. dollar influences both currencies, that is why reliable projection of a future behaviour of this financial instrument requires considering the major U.S. economic indicators such as the discount rate, GDP, unemployment, new vacancies, etc. It should be said that the discussed currencies may react to changes in the U.S. economy with different speed, so the CHF/SEK pair can be regarded as a specific indicator of changes in these currencies.

The economic situation in Switzerland has been serene for several centuries. For this reason, the Swiss franc enjoys firm confidence across the globe as one of the most stable world currencies. In addition, the Swiss franc is a sort of safe haven for capital investment at a time of a crisis. Therefore, during a crisis, the capital is urgently moved to Switzerland, and the Swiss franc surges against other currencies. This characteristic of the Swiss economy should be taken into account in trading.

Sweden is one of the most powerful economies in the world, running far ahead of its closest neighbours: Denmark, Norway, and Finland. Sweden was able to achieve excellent economic performance as it is very rich in minerals, and its citizens are highly-qualified workers. The country also abounds with substantial deposits of iron ore and non-ferrous metals. Furthermore, Sweden has large timber and hydropower resources.

Sweden is the biggest manufacturer of engineering products and the largest supplier of iron ore, steel, and paper. The major part of Swedish products goes to foreign markets. However, at the same time Sweden relies heavily on exports. A decrease in exports can markedly weaken the national economy. It is also worth noting that Sweden is dependent on the world prices of oil and gas. Significant increases in prices for these energy resources may affect the value of the Swedish krona and cause some economic problems.

This trading instrument is relatively illiquid in comparison with the major currency pairs such as EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when you forecast future dynamics of this financial instrument, you should primarily focus on the currency pairs that include the U.S. dollar coupled with each of the considered currencies.

If you trade cross rates, bear in mind that brokers usually set a higher spread than for more popular currency pairs. So, before you start working with cross rates, carefully learn the conditions offered by the broker.

See Also

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 15-18, 2025: sell below $3,220 (+1/8 Murray - 21 SMA)

The Eagle indicator is reaching overbought levels, so we will look for opportunities to sell below its high of 3,245, with targets at 3,200, 3,170, and finally 3,125.Author: Dimitrios Zappas

14:05 2025-04-15 UTC+2

1408

Markets remain in shock over Trump's actionsAuthor: Samir Klishi

11:55 2025-04-15 UTC+2

1228

Today, gold is rising, trading near the all-time high reached the previous day, amid growing uncertainty surrounding the US-China trade wars.Author: Irina Yanina

12:18 2025-04-15 UTC+2

1228

- Bears continue to retreat

Author: Samir Klishi

11:59 2025-04-15 UTC+2

1138

The EUR/USD exchange rate remained virtually unchanged throughout Tuesday — something that hasn't happened in the forex market for a while.Author: Chin Zhao

19:03 2025-04-15 UTC+2

1108

The Japanese yen is facing difficulties in continuing its rally amid optimistic news on trade talks and tariff delaysAuthor: Irina Yanina

12:08 2025-04-15 UTC+2

1018

- The GBP/USD exchange rate rose another 40 basis points on Tuesday.

Author: Chin Zhao

18:56 2025-04-15 UTC+2

1003

Tuesday's premarket opens with uncertainty, a state that often precedes a storm rather than calm on Wall Street. The S&P 500 futures are sliding toward 5,420 after a strong Monday session, once again led by tech giants.Author: Natalya Andreeva

11:52 2025-04-15 UTC+2

853

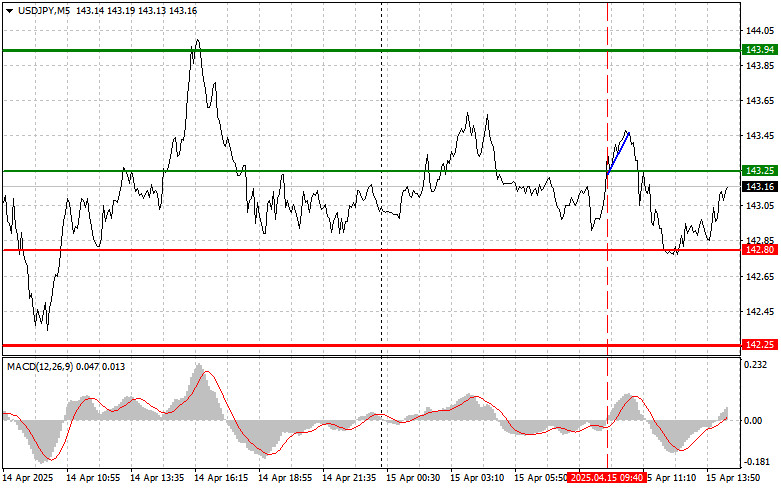

USD/JPY: Simple Trading Tips for Beginner Traders on April 15th (U.S. Session)Author: Jakub Novak

18:53 2025-04-15 UTC+2

853

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 15-18, 2025: sell below $3,220 (+1/8 Murray - 21 SMA)

The Eagle indicator is reaching overbought levels, so we will look for opportunities to sell below its high of 3,245, with targets at 3,200, 3,170, and finally 3,125.Author: Dimitrios Zappas

14:05 2025-04-15 UTC+2

1408

- Markets remain in shock over Trump's actions

Author: Samir Klishi

11:55 2025-04-15 UTC+2

1228

- Today, gold is rising, trading near the all-time high reached the previous day, amid growing uncertainty surrounding the US-China trade wars.

Author: Irina Yanina

12:18 2025-04-15 UTC+2

1228

- Bears continue to retreat

Author: Samir Klishi

11:59 2025-04-15 UTC+2

1138

- The EUR/USD exchange rate remained virtually unchanged throughout Tuesday — something that hasn't happened in the forex market for a while.

Author: Chin Zhao

19:03 2025-04-15 UTC+2

1108

- The Japanese yen is facing difficulties in continuing its rally amid optimistic news on trade talks and tariff delays

Author: Irina Yanina

12:08 2025-04-15 UTC+2

1018

- The GBP/USD exchange rate rose another 40 basis points on Tuesday.

Author: Chin Zhao

18:56 2025-04-15 UTC+2

1003

- Tuesday's premarket opens with uncertainty, a state that often precedes a storm rather than calm on Wall Street. The S&P 500 futures are sliding toward 5,420 after a strong Monday session, once again led by tech giants.

Author: Natalya Andreeva

11:52 2025-04-15 UTC+2

853

- USD/JPY: Simple Trading Tips for Beginner Traders on April 15th (U.S. Session)

Author: Jakub Novak

18:53 2025-04-15 UTC+2

853