Mastering how to mine cryptocurrency is a vital step for those exploring digital assets. While learning how to buy cryptocurrency is a popular entry point, engaging in the process itself provides a direct method to acquire tokens while contributing to the functionality of decentralized networks. This approach not only offers tangible rewards but also strengthens the infrastructure supporting the digital ecosystem.

What Is Mining, Why Is It Significant?

- Securing digital systems. The process involves verifying as well as recording transaction details on a decentralized ledger. Participants solve intricate mathematical challenges to construct new blocks, ensuring data integrity while preventing fraudulent activities like double-spending. Each addition to the ledger reinforces trust, transparency, security within the ecosystem.

- Supporting decentralized operations. Unlike traditional financial systems relying on centralized authorities, this method empowers a distributed network of contributors. This global framework ensures no single entity exerts control, bolstering system resilience along with resistance to censorship. Such decentralization is a cornerstone of blockchain technology, offering fairness as well as inclusivity to all participants.

- Providing incentives. Participants are rewarded for their efforts with network-issued tokens. This system serves a dual purpose: encouraging ongoing contributions while managing the controlled introduction of new tokens into circulation. The reward mechanism aligns personal interests with the network’s growth, creating a mutually beneficial relationship.

The Evolution of Mining

1. Progression of Tools and Techniques

- Early days: at first, individuals could participate using standard personal computers. The minimal computational power required made it accessible to hobbyists as well as enthusiasts.

- Hardware advancements: as networks grew, algorithms became more complex, more advanced tools like GPUs (Graphics Processing Units), ASICs (Application-Specific Integrated Circuits) became essential for competitive participation. These devices significantly increased efficiency along with output.

- Modern landscape: today’s operations range from professional-grade facilities housed in data centers to smaller-scale efforts leveraging innovative methods such as cloud-based services or mobile applications. These advancements have enhanced accessibility while maintaining competitiveness.

2. Diverse Approaches for Engagement

- High-performance equipment remains the most effective solution for serious contributors seeking maximum efficiency as well as output.

- Cloud-based platforms offer an alternative, allowing individuals to participate without owning physical hardware. These services enable users to rent computational resources for their activities.

- Mobile applications provide a convenient entry point for beginners, offering an intuitive way to explore the space without significant financial commitment or technical expertise.

Why This Process Is Vital for Digital Assets

- Ensuring transaction integrity. The validation process ensures every exchange is accurately recorded on the ledger, creating a secure, transparent system. This integrity builds trust among users, facilitates the widespread adoption of digital assets.

- Promoting decentralized systems. By distributing validation responsibilities across a global network, this approach eliminates reliance on centralized intermediaries. Such distribution fosters inclusivity, fairness, resistance to undue influence or manipulation.

- Incentivizing participation. The reward mechanism encourages ongoing contributions while ensuring the network remains functional as well as stable. These incentives create a sustainable ecosystem that benefits both participants and the broader community.

What You’ll Gain From This Guide

- Getting started. Mastering how to mine cryptocurrency involves learning about essential tools as well as equipment required for participation. Explore beginner-friendly options, such as mobile applications, designed to simplify the process for newcomers.

- Evaluating profitability. Know key factors like hardware costs, electricity usage, market dynamics. Utilize calculation tools to estimate potential returns, enabling informed decision-making.

- Securing your operations. Adopt strategies to protect against malware, phishing attacks, other risks. Follow established best practices to safeguard your equipment along with earnings effectively.

- Considering environmental impact. Discover sustainable practices to minimize energy consumption. Comprehend how individual efforts contribute to the broader conversation about environmental responsibility in the digital asset industry.

This guide provides a clear, structured pathway for navigating the process of cryptocurrency mining. By breaking down technical concepts into actionable insights, it ensures a comprehensive mastering not just of the mining process, but also of how to do so efficiently and responsibly. Whether your goal is earning tokens, broadening your knowledge, or supporting a decentralized network, this guide equips you with the tools needed for success in the evolving world of digital assets.

Understanding Cryptocurrency Mining

Mining is the backbone of blockchain networks, safeguarding their integrity as well as operational stability. It involves solving intricate computational challenges to verify transactions, which are then recorded on a digital ledger called the blockchain. Each verified transaction is grouped into a block, linked to preceding blocks, forming a secure, unbroken data chain.

Participants, often called miners, compete by solving these puzzles. The first to succeed adds the block to the network, earning a reward for their contribution. These rewards are typically issued in the form of the network's native tokens, creating an incentive for ongoing involvement. This mechanism not only ensures network reliability but also gradually releases new tokens into circulation, adhering to a controlled supply schedule.

How Miners Earn Rewards

- Transaction fees. Every transaction includes a small fee paid to the miner responsible for validation. On active networks, these fees can become a significant source of revenue.

- Block rewards. Miners receive a fixed number of tokens for successfully validating a block. Over time, these rewards are designed to diminish through a process called halving. For instance, in Bitcoin's system, block rewards decrease roughly every four years to maintain a predictable supply rate.

- Combined incentives. When transaction fees along with block rewards are added together, mining can become a profitable venture. However, profitability depends on variables like energy consumption, token market prices.

The Evolution of Mining

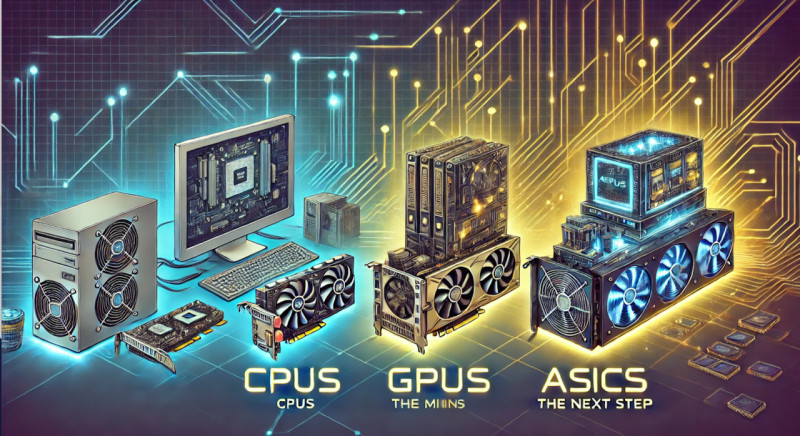

From CPUs to GPUs

- Early days. Initially, mining relied on standard CPUs found in most computers. Early algorithms had low difficulty levels, allowing enthusiasts to participate with minimal investment. This phase featured limited competition along with modest earnings.

- The rise of GPUs. As participation increased, algorithms grew more complex, rendering CPUs inadequate. To meet these demands, miners began utilizing GPUs. Originally designed for graphic rendering, GPUs excel at performing parallel computations needed for blockchain algorithms, offering superior efficiency at manageable costs.

ASICs: The Next Step

- Specialized Hardware Emerges:

- Application-Specific Integrated Circuits (ASICs) were introduced to streamline the process of how to mine cryptocurrency. These machines are designed to manage specific computations with unmatched precision along with speed.

- ASICs quickly became essential for high-performance operations, particularly on major networks such as Bitcoin.

- Industrial-Scale Ventures:

- ASICs enabled the rise of large-scale operations, commonly known as mining farms. These facilities deploy hundreds or thousands of devices to maximize output.

- Running such operations requires significant investments in machinery, energy, cooling systems, making them viable mostly for organizations with substantial resources.

Cloud-Based Mining

Cloud mining allows individuals to lease computational power from large facilities rather than managing hardware independently. This setup eliminates the need for technical skills or initial hardware costs.

- Advantages, risks:

- Advantages: simplifies access, reduces financial barriers, avoids issues like hardware upkeep.

- Challenges: success depends on trusting providers, as some services have proven fraudulent. Contracts may also impose rigid terms, reducing participant flexibility.

Mastering the process of mining digital assets today involves grasping the evolution of tools as well as approaches. What began as a simple activity on personal computers has expanded into a global enterprise with numerous methods. Whether using advanced hardware, exploring cloud-based solutions, or scaling up to industrial-sized operations, this process remains fundamental to blockchain networks. It safeguards their functionality, maintains security, provides opportunities for financial gains.

How to Start Mining

Beginning your journey in this field involves more than simply connecting devices, launching applications. The tools you select as well as strategies you employ directly influence efficiency along with earning potential. From picking suitable equipment to fine-tuning your setup and collaborating with shared networks, knowing essential principles is critical for success. This guide outlines the steps to get started, offering practical advice for both novices as well as seasoned participants.

Selecting Hardware

The devices you use play a critical role in determining outcomes. Various options suit different networks as well as budgets, so aligning your choice with your objectives is crucial.

| Hardware | Overview | Advantages | Drawbacks |

| CPUs (Central Processing Units) | these general-purpose processors, standard in most computers, were initially used for solving blockchain puzzles | inexpensive, simple to configure, ideal for beginners or those experimenting with smaller networks requiring less computational power | limited efficiency along with slower performance compared to modern alternatives; not suitable for high-demand networks |

GPUs (Graphics Processing Units) | initially created for rendering graphics, GPUs excel in managing parallel computations, making them well-suited for blockchain tasks | greater processing power than CPUs, adaptable across various networks, commonly used in mid-tier operations | higher cost compared to CPUs along with increased energy usage, resulting in elevated operational expenses |

| ASICs (Application-Specific Integrated Circuits) | purpose-built devices optimized for blockchain computations | exceptional performance as well as efficiency, particularly for large-scale networks; these machines yield greater returns when deployed effectively | significant upfront investment, limited adaptability to different networks, higher electricity consumption; ideal for professional setups or large operations |

Configuring Software

Downloading, installing

- Select programs compatible with your chosen hardware along with the network you wish to engage with.

- Obtain software from reputable sources to avoid security risks. Popular options include CGMiner, NiceHash, PhoenixMiner.

Adjusting settings

- To start the process of how to mine cryptocurrency follow the setup instructions provided by your selected software. You’ll need details like your wallet address (where rewards are sent) as well as the network being accessed.

- Optimize parameters such as fan speed, power consumption, overclocking (for GPUs) to enhance performance.

Launching operations

- Once settings are adjusted, start the software, monitor performance metrics. Most tools display real-time data, such as hash rates, temperatures, earnings.

- Regular updates ensure you benefit from security fixes along with performance enhancements.

Joining Collaborative Networks

Why Collaborate?

Pooling computational resources increases the likelihood of solving blocks, receiving rewards.

Participants share earnings based on their contributions, making this a viable option for those with modest hardware.

Choosing a Trusted Network

Consider these factors:

- Reputation: investigate user feedback, track record.

- Fees: compare pool charges to ensure profitability.

- Payment models: select a structure that aligns with your goals, such as pay-per-share for consistent payouts or systems based on block rewards.

Getting Started

Sign up with your chosen pool, connect it to your software by entering the necessary URL as well as port details. Monitor contributions along with earnings via the pool’s dashboard.

Maximizing Efficiency

Successfully participating in digital asset creation requires a thoughtful blend of hardware, software, strategy. By carefully choosing your equipment, configuring tools effectively, leveraging collaborative networks, you can enhance both performance and rewards. Whether starting with a modest setup or advancing to complex systems, this approach provides a clear path for engaging with cryptocurrency while achieving your goals.

How to Mine Cryptocurrency from Phone

Using a smartphone for mining represents a simplified approach compared to high-performance setups like GPUs or ASICs. Mobile apps enable this by harnessing a phone's processing power for validating transactions or contributing to blockchain networks. Though not as efficient as specialized hardware, these tools provide an accessible starting point for those new to the space.

Most mobile-based solutions operate with lightweight algorithms, which are less demanding on devices. Users can earn small token amounts while learning about blockchain ecosystems. Some apps even mimic the process, rewarding participants with tokens to foster engagement in the network.

Examples of Popular Apps

- MinerGate Mobile Miner. This well-known app enables users to earn tokens through smartphones. It supports multiple token types, includes an integrated wallet for payouts, offers straightforward tracking of progress.

- Pi Network. Pi Network focuses on community-building within a decentralized economy. Users earn tokens by participating as well as maintaining engagement within the network.

- CryptoTab Browser. This browser combines web browsing with token generation, rewarding users as they perform everyday online tasks. It’s an easy way to earn while surfing the web.

- AA Miner. AA Miner supports various algorithms, offers flexibility for those exploring different assets. It provides an ad-free experience, making it a popular choice among advanced users.

Benefits, Drawbacks

| Advantages | Drawbacks |

| Accessibility: participation requires only a smartphone, removing the need for expensive equipment | Reduced processing power: smartphones lack the capability of specialized hardware, leading to slower performance along with minimal output |

| Simplicity: mobile apps are intuitive, require minimal setup, making them ideal for beginners | Small returns: earnings from mobile apps are significantly lower compared to other methods |

| Learning opportunity: they offer a hands-on introduction to blockchain technology as well as token creation with little financial risk for those who master how to mine cryptocurrency | Device wear: prolonged use for intensive tasks can overheat devices, shorten their lifespan, drain batteries quickly |

Getting Started

- Select an app. Research reliable apps that match your goals. Check for positive feedback, transparent reward systems, device compatibility.

- Install, set up. Download from trusted platforms like Google Play or the App Store. Complete installation, register an account. Input your wallet address for reward deposits or use the integrated wallet if available.

- Adjust configurations. Tweak settings such as algorithm type (if applicable), workload intensity, payout thresholds. Monitor device performance to prevent overheating or excessive battery consumption.

- Begin generating tokens. Activate the app’s token generation feature, monitor progress through real-time updates. Most apps display earnings along with system performance metrics.

Best Practices for Mobile Mining

- Optimize efficiency: use your device while plugged in to preserve battery life.

- Protect device health: limit session durations to avoid overheating as well as long-term wear on hardware.

- Stay safe: only download apps from reputable sources to safeguard against malware or phishing attempts.

- Manage expectations: recognize that mobile setups yield minimal returns and are best viewed as a learning experience or hobby.

Though not the most productive method, mobile mining provides a unique way to explore the process with minimal commitment. It’s an excellent option for beginners curious about blockchain systems. However, for those aiming for substantial returns, advancing to specialized hardware or collaborative networks may be necessary. By combining careful planning along with best practices, mobile-based mining can serve as an enjoyable as well as educational introduction to the world of cryptocurrency.

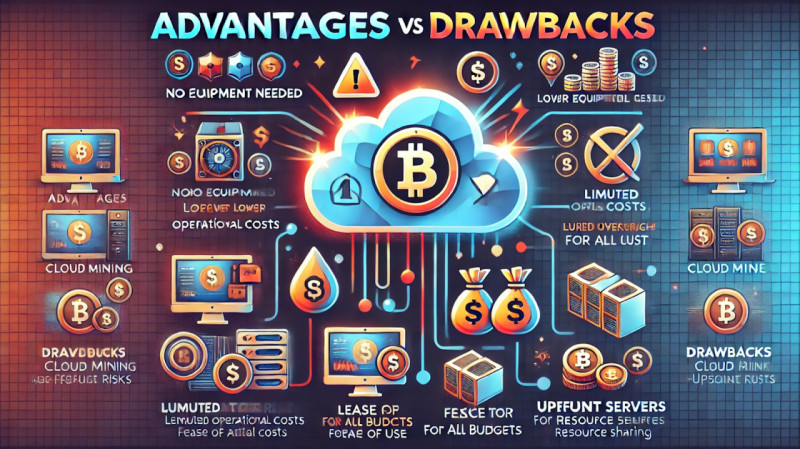

Cloud Mining

Cloud mining enables individuals to rent computational resources from third-party providers for generating digital tokens. This approach eliminates the need for owning or managing specialized equipment, as service providers manage all aspects of operations, including hardware setup, software configuration, energy consumption, maintenance. Users pay for access through contracts that specify the service duration, allocated processing power, expected returns.

This model allows participation in token generation without the significant technical or financial hurdles associated with traditional setups. Instead of investing in expensive GPUs or ASICs as well as dedicating physical space for operations, users lease a share of a provider’s resources for a fee. In return, they receive rewards proportionate to their contract terms.

Pros and Cons

Advantages

- No equipment needed: cloud services remove the expenses as well as hassle of purchasing, researching, or upgrading hardware. This can save thousands of dollars upfront.

- Lower operational costs: high energy bills, cooling system expenses are borne by the provider. This allows users to participate without concerns about energy use or hardware upkeep.

- Ease of use: most cloud platforms are beginner-friendly, simplifying the process of how to mine cryptocurrency. Users simply sign up, choose a plan, begin earning rewards.

- Flexibility for all budgets: contracts are customizable, catering to both small-scale participants and larger investors. Users can enhance their participation over time by upgrading plans as their confidence grows.

- Passive income potential: once the agreement is active, users can earn rewards without managing daily operations, making it a convenient, hands-off option.

Drawbacks

- Fraud risks: some providers have scammed users by promising unrealistic returns, then disappearing. Proper research is critical to avoid losing funds.

- Limited oversight: users lack direct control over equipment or processes. Success depends entirely on the provider’s efficiency along with integrity.

- Upfront costs: contracts often require significant payments in advance. Returns are influenced by market conditions, network challenges, operational expenses, which can fluctuate as well as impact profitability.

- Resource sharing: facilities often divide resources among multiple users. Priority is often given to larger contracts, potentially reducing payouts for smaller participants.

- Opaque practices: some providers offer little insight into their operations, leaving users unsure about the specifics of resource allocation or token-generation efficiency.

Choosing a Reliable Provider

Research reputation

- Select providers with established credibility as well as positive feedback. Avoid services offering suspiciously high returns without clear operational details.

- Check forums, independent reviews, testimonials for user experiences.

Understand contract details

- Thoroughly review agreements to confirm clarity on costs, duration, reward structures. Watch for hidden fees or withdrawal restrictions.

- Ensure maintenance charges along with payout policies are clearly outlined.

Examine payout systems

- Assess payout frequency as well as distribution methods. Ideally, rewards should be delivered directly to your wallet promptly, transparently.

- Ensure the service supports your preferred tokens or blockchain networks.

Analyze costs, fees

- Compare options to find competitive pricing. Account for contract fees, maintenance charges, withdrawal costs to estimate returns accurately.

Evaluate transparency

- Reputable providers disclose details about their facilities, equipment, operations. A lack of openness can be a warning sign.

- Some services offer real-time dashboards for users to monitor computational contributions along with earnings.

Conclusion

Cloud mining offers an approachable alternative for individuals looking to engage with digital token generation without managing physical equipment. While the method simplifies participation, reduces barriers, it carries risks that require attention.

By conducting thorough research, carefully reviewing contract terms, maintaining realistic expectations, cloud services can serve as a convenient entry point for mastering the mining process. However, ensuring a positive experience depends on choosing trustworthy providers that prioritize transparency along with user satisfaction.

Profitability of Mining

Profitability is a critical consideration for anyone exploring the process of mining digital assets. While earning tokens might sound appealing, several factors significantly influence potential returns, such as equipment costs, energy expenses, market volatility.

Knowing these elements, estimating earnings beforehand ensures a practical approach when evaluating whether this activity aligns with your goals. This section examines key factors affecting profitability, ways to estimate earnings, scenarios where it makes the most sense to engage in mining.

Key Factors Influencing Profitability

- Hardware expenses

- The type of equipment chosen plays a vital role in determining success in mastering how to mine cryptocurrency. Basic GPUs involve lower upfront investment but yield modest returns, whereas advanced ASICs offer higher rewards but require a substantial initial outlay.

- Depreciation further impacts long-term gains. Rapid advancements in technology can render older equipment inefficient as network requirements become more demanding.

- Energy Costs

- Power consumption represents one of the largest ongoing expenses. High electricity rates can significantly reduce earnings. Locations with access to low-cost energy, such as hydroelectric or geothermal power, are more favorable for operations.

- Energy-efficient hardware helps offset electricity expenses, though these devices often come with a higher purchase price.

- Network Complexity

- Difficulty levels determine how challenging it is to validate a new block. As more participants join, competition increases, raising complexity as well as reducing efficiency.

- Higher difficulty forces miners to use advanced hardware or work longer hours, which may diminish profitability over time.

- Token Market Value

- Profitability heavily depends on token prices. A sharp drop in value can transform a profitable setup into a loss-making venture, whereas price surges amplify earnings.

- Staying informed about market trends as well as timing operations based on token values can improve returns.

Estimating Potential Returns

Using Calculation Tools

Profitability calculators such as WhatToMine or CryptoCompare allow users to input variables like hardware performance, electricity rates, network complexity. These tools estimate earnings based on metrics such as block rewards, transaction fees.

Essential Metrics

- Hash rate: measures your device’s computational power, which directly impacts efficiency.

- Energy cost per kWh: accurately estimating electricity usage ensures realistic profitability calculations.

- Difficulty levels: regularly updated, this metric affects the number of tokens earned within a specific timeframe.

Costs vs. Returns: Real-World Scenarios

Small-scale setup

- Equipment: a mid-range GPU priced at $800.

- Monthly energy expense: $60 (at $0.10/kWh).

- Monthly earnings: tokens worth approximately $100.

- Net profit: $40 per month, requiring around 20 months to recover initial costs (excluding market fluctuations).

Industrial Setup

- Equipment: ten high-end ASICs at $15,000 each.

- Monthly energy expense: $5,000.

- Monthly earnings: tokens worth $25,000.

- Net profit: $20,000 per month, achieving break-even within less than a year, assuming stable token prices.

When Does Mining Make Sense?

- Affordable energy access. Regions with low power costs make mining more viable. Countries offering renewable energy at favorable rates often attract large-scale operations.

- Strong market conditions. Mining is most rewarding during periods of high token prices. Operating during price surges can significantly enhance profitability.

- Scalability. Investing in scalable hardware or joining pools reduces risks, increases efficiency. Collaborative efforts enable participants to share resources, compete without massive individual investments.

- Hobbyist vs. professional approach. For hobbyists, this activity can be an educational experience with modest returns. For serious investors, conducting a detailed cost-benefit analysis is essential for ensuring long-term success.

Conclusion

Engaging in token generation effectively requires careful evaluation of costs, market dynamics, scalability. By analyzing these variables as well as leveraging tools such as profitability calculators, individuals can make informed decisions about whether this endeavor aligns with their financial objectives. Whether approached as a learning opportunity or a serious investment, success in how to mine cryptocurrency depends on balancing initial costs with potential rewards.

Challenges, Risks

While mining offers potential rewards, it also comes with significant challenges along with risks. From technical hurdles to navigating volatile markets, participants face numerous obstacles that require careful planning. Security threats, such as malware or scams, further complicate operations. Addressing these issues with proactive strategies is critical for protecting investments, ensuring profitability. This section outlines common difficulties, offers actionable solutions.

Technical, Financial Obstacles

Hardware maintenance

- Mining devices require regular care to maintain efficiency. Dust accumulation, overheating, or wear can lead to reduced output or failure.

- Routine cleaning, monitoring, timely replacements are essential for extending equipment life as well as ensuring reliable performance.

Heat management

- Devices like GPUs or ASICs generate considerable heat during prolonged use, which can degrade components or hinder performance.

- Cooling solutions — such as fans, air conditioning, or liquid cooling — are necessary to regulate temperatures. However, these add to operational expenses, requiring careful cost management.

Energy usage

- High-performance equipment consumes substantial electricity, often making energy costs the largest recurring expense.

- Outdated or inefficient setups can inflate power consumption, reducing returns. Optimizing systems for energy efficiency is vital for sustainable operations.

Market volatility

- Token value fluctuations present a significant financial risk. Sudden price drops can render operations unprofitable, particularly for those with high fixed expenses like electricity or loans for equipment.

- Diversifying income streams, such as staking or trading, can help offset the impact of market downturns as well as stabilize earnings.

Security Threats

Malware, Hacking

- Mining setups are attractive targets for cyberattacks aimed at stealing computational resources or accessing wallets. Malware often infiltrates systems through unsecured downloads or weak network security.

- Installing antivirus software, using firewalls, keeping systems updated are key measures to reduce vulnerabilities.

Phishing Scams

- Fraudsters often trick participants into sharing sensitive data, such as wallet credentials, by mimicking legitimate websites or services.

- Verifying website URLs, avoiding unsolicited links, using two-factor authentication can prevent falling victim to these schemes.

Fraudulent Providers

- Scams are common in cloud-based services, where dishonest operators promise high returns and disappear with user funds.

- Researching providers thoroughly, selecting well-established companies with transparent practices is essential to avoid these traps.

Best Practices for Secure Operations

Invest in trusted equipment and software

- Purchase devices from reputable manufacturers, download programs only from official sources. This reduces the risk of counterfeit or compromised products.

- Regular updates ensure access to the latest security features along with performance improvements.

Strengthen security protocols

- Use complex passwords, enable two-factor authentication across accounts.

- Keep mining rigs isolated from personal devices or sensitive data by creating dedicated networks.

Monitor performance continuously

- Track device output, energy consumption, system health to identify irregularities early.

- Set up alerts for temperature spikes or unusual power usage to address issues promptly.

Diversify revenue sources

- Given the unpredictable nature of mining, diversifying activities, such as staking or token trading, can help stabilize income during challenging periods.

Conclusion

Engaging in mining involves navigating both technical and financial risks. By maintaining secure systems, addressing vulnerabilities, managing costs effectively, participants can reduce exposure to potential setbacks while mastering how to mine cryptocurrency. Implementing best practices, staying informed about industry trends ensures a safer, more rewarding experience. Whether approached as a hobby or a professional venture, success lies in preparation as well as vigilance.

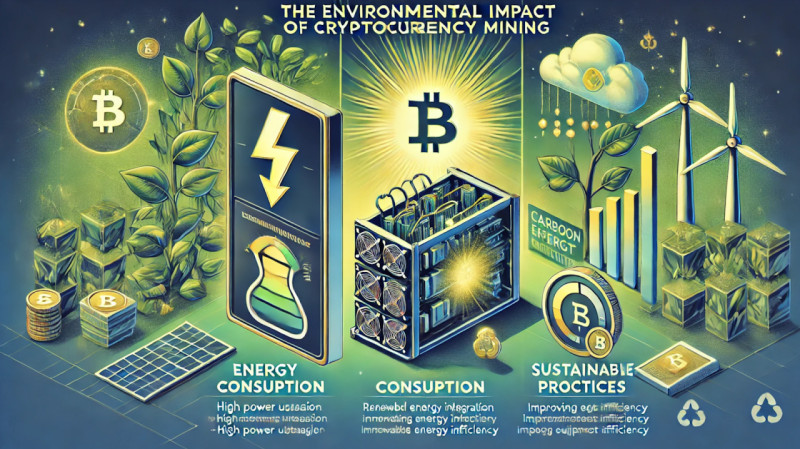

The Environmental Impact of Mining

The energy-intensive nature of mining has raised concerns about its environmental effects. The substantial electricity demand for computational tasks has fueled discussions about sustainability, the future of this activity.

However, innovative strategies along with technologies are being developed to address these challenges. This section examines energy consumption, compares various methods, explores sustainable practices as well as advancements paving the way for a more eco-friendly future.

Energy Consumption

High Power Usage

Generating digital tokens requires significant computational effort, leading to substantial electricity consumption. Devices like ASICs, GPUs operate at maximum capacity for long durations, drawing power continuously.

Large-scale operations, known as mining farms, amplify this demand by running hundreds or thousands of machines. These facilities can consume as much energy as small cities, raising concerns about their carbon footprint.

Comparing Energy Across Methods

- Proof-of-Work (PoW): traditional systems, such as Bitcoin, rely on solving complex algorithms. This energy-intensive process significantly contributes to electricity usage.

- Proof-of-Stake (PoS): networks adopting PoS require validators to stake tokens instead of solving problems. PoS uses a fraction of the energy needed for PoW, offering a more sustainable option.

- Hybrid approaches: some networks combine PoW and PoS, balancing security with energy efficiency, signaling a shift toward greener solutions.

Sustainable Practices

- Renewable energy integration

- The process of mining digital assets is increasingly shifting toward renewable sources like solar, wind, hydroelectric power. These alternatives dramatically reduce greenhouse gas emissions compared to fossil fuels.

- Countries rich in renewable energy resources, such as Iceland or Canada, are becoming hubs for environmentally conscious operations.

- Improving equipment efficiency

- Energy-efficient hardware minimizes electricity use without compromising performance. Newer ASICs, optimized GPUs deliver better output per watt.

- Tools for overclocking as well as advanced cooling systems further enhance efficiency, lowering the overall energy demand of mining setups.

- Carbon offset initiatives

- Certain companies implement offset programs to neutralize emissions. These efforts include funding renewable energy projects or tree-planting campaigns to compensate for their environmental impact.

Emerging Technologies

- Liquid immersion cooling

- Traditional air-cooling systems are power-intensive as well as often inefficient. Liquid immersion cooling, where hardware is submerged in non-conductive liquids, improves thermal management while using less energy.

- This approach also extends equipment lifespan by maintaining optimal operating temperatures.

- AI-driven optimization

- Artificial intelligence helps monitor, enhance operations. AI tools analyze real-time data to adjust power usage, refine cooling methods, boost computational performance.

- Greener consensus models

- Many networks are moving toward eco-friendly consensus models like PoS, which require far less energy than PoW. Ethereum’s transition from PoW to PoS with Ethereum 2.0 exemplifies this trend.

- Utilizing stranded energy

- Stranded energy refers to power generated in remote areas that cannot be easily distributed. By using this otherwise wasted energy, operations in these regions convert surplus power into economic value without burdening local grids.

Conclusion

Recognizing the environmental effects is vital for those learning how to mine cryptocurrency responsibly. Embracing sustainable approaches, adopting renewable energy, supporting innovative technologies allow participants to minimize their carbon footprint while contributing to the network. Balancing profitability with environmental awareness ensures that mining remains viable while aligning with global sustainability objectives.

Conclusion

The Future of Mining

The generation of digital tokens is experiencing rapid evolution. Traditional proof-of-work (PoW) mechanisms, known for their energy-intensive processes, are being supplemented or replaced by proof-of-stake (PoS) models. PoS validates transactions through token ownership rather than computational effort, offering a more inclusive as well as environmentally sustainable approach. This transition, embraced by major networks like Ethereum, highlights a broader shift toward greener practices within the industry.

Advancements in hardware and software are also redefining operations. Energy-efficient GPUs, ASICs, paired with innovative cooling solutions such as liquid immersion systems, are driving down costs while improving sustainability. These developments empower not only large-scale enterprises but also smaller participants by reducing prohibitive entry barriers. Additionally, AI-based tools are optimizing performance along with energy use, enabling smarter, more efficient operations.

Cloud-based platforms are further democratizing access. Renting computational resources eliminates the need for expensive hardware as well as high energy costs, making participation feasible for hobbyists along with small-scale users. This model provides a controlled, accessible way to learn the mining process while managing risks effectively.

Sustainability is becoming a cornerstone of the industry, with renewable energy sources like solar, wind, hydroelectric power increasingly integrated into operations. These efforts align token generation with global environmental initiatives to reduce carbon emissions, promote green energy adoption. The future of mining lies at the intersection of technological innovation as well as ecological responsibility, ensuring its ongoing relevance in a changing world.

Your Next Steps

Start with the Right Tools

- Choosing the proper tools is essential for success. Beginners may find GPUs a flexible starting point, while ASICs are ideal for high-performance needs targeting specific networks.

- Carefully explore software options, ensuring compatibility with your hardware. Programs such as CGMiner, NiceHash offer reliable solutions for both newcomers and seasoned participants.

Continuously Broaden Your Knowledge

- The digital token industry evolves quickly, making ongoing education vital. Stay updated by subscribing to industry news, participating in webinars, engaging in community forums.

- Mastering the process of mining digital assets requires mastering both technological advancements and market trends. Keeping your knowledge current helps maintain a competitive edge.

Prioritize Security

- Safeguarding your equipment along with earnings is critical. Use strong passwords, enable two-factor authentication, regularly update software to protect against malware or phishing attempts.

- Purchase reliable equipment from trusted sources to avoid disruptions or losses from faulty hardware.

Assess Profitability Thoughtfully

- Utilize profitability calculators to estimate potential returns by considering factors like hardware efficiency, energy costs, token market value. These tools guide decisions on whether your setup is financially viable.

- Remember that returns vary with market conditions. Diversify income sources, such as staking or trading, to mitigate potential losses during downturns.

Commit to Sustainability

- Incorporating renewable energy into operations reduces costs, minimizes environmental impact. Locating setups in areas with affordable green energy can significantly improve efficiency while mastering how to mine cryptocurrency.

- Upgrade to energy-efficient hardware along with advanced cooling systems to further optimize performance while reducing electricity consumption.

Experiment, Diversify

- Diversify token generation strategies by exploring options like cloud platforms or staking. This reduces reliance on a single income source, increases adaptability in fluctuating markets.

- Test new methods on a smaller scale before committing to larger investments, ensuring alignment with long-term objectives.

Final Thoughts

Digital token generation presents numerous opportunities for those willing to approach it thoughtfully. Whether you’re a beginner or refining advanced strategies, success depends on staying informed, securing operations, adopting sustainable methods. Balancing technological advancements with financial, ecological responsibility ensures meaningful participation in this complex industry.

As the landscape evolves, opportunities to engage expand. From cutting-edge hardware to cloud services and staking, there are countless ways to contribute to the decentralized economy. By mastering the process of mining digital assets as well as committing to best practices, you can ensure your efforts are profitable and beneficial to the broader ecosystem. Start your journey today with the knowledge as well as tools to thrive in this dynamic, rewarding field.