Triple Top

was formed on 31.03 at 08:30:26 (UTC+0)

signal strength 3 of 5

The Triple Top pattern has formed on the chart of the EURCAD M30. Features of the pattern: borders have an ascending angle; the lower line of the pattern has the coordinates 1.5476/1.5505 with the upper limit 1.5517/1.5519; the projection of the width is 41 points. The formation of the Triple Top figure most likely indicates a change in the trend from upward to downward. This means that in the event of a breakdown of the support level of 1.5476, the price is most likely to continue the downward movement.

আরও দেখুন

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

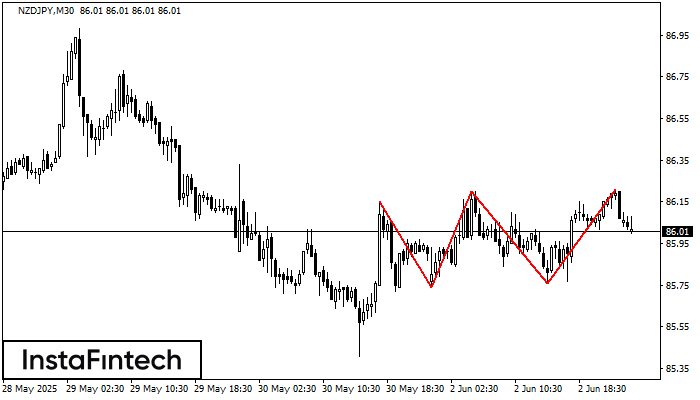

ট্রিপল টপ

was formed on 03.06 at 00:30:20 (UTC+0)

signal strength 3 of 5

M30 চার্টে NZDJPY-এর ট্রিপল টপ প্যাটার্নটি গঠিত হয়েছে। প্যাটার্নের বৈশিষ্ট্য: এই প্যাটার্নের সীমানাগুলোতে একটি ঊর্ধ্বমুখী অ্যাঙ্গেল বা কোণ আছে; প্যাটার্নের নীচের লাইনে 85.74/85.76-এর কোঅর্ডিনেট রয়েছে, উপরের সীমা 86.15/86.21; প্রস্থের প্রজেকশন

Open chart in a new window

ট্রিপল বটম

was formed on 03.06 at 00:05:20 (UTC+0)

signal strength 1 of 5

M5 চার্টে USDJPY-এর ট্রিপল বটম প্যাটার্নটি গঠিত হয়েছে। প্যাটার্নের বৈশিষ্ট্য: প্যাটার্নের নীচের লাইনে কোঅর্ডিনেট 142.75 রয়েছে এবং এটির উপরের সীমা 142.75/142.69, প্রস্থের প্রজেকশন হল 7 পয়েন্ট। ট্রিপল বটম প্যাটার্নের

M5 এবং M15 টাইম ফ্রেমে আরও ভুল এন্ট্রি পয়েন্ট থাকতে পারে।

Open chart in a new window

ট্রিপল বটম

was formed on 03.06 at 00:00:22 (UTC+0)

signal strength 3 of 5

M30 চার্টে, USDCHF ট্রেডিং ইন্সট্রুমেন্টের ট্রিপল বটম প্যাটার্ন গঠিত হয়েছে। 0.8190/0.8184 ব্রেকডাউনের ক্ষেত্রে এই প্যাটার্ন নিম্নমুখী প্রবণতা থেকে ঊর্ধ্বমুখী প্রবণতায় পরিবর্তনের সংকেত দেয়৷

Open chart in a new window